Welcome, dear reader! Have you ever wondered how to calculate ERP using a formula? Enterprise Resource Planning (ERP) is a crucial tool for businesses to manage their resources efficiently. By understanding the calculation process, you can better optimize your company’s operations. In this article, we will break down the steps on how to calculate ERP with a formula, making it easier for you to implement in your business strategy.

Understanding the ERP Calculator Formula

When it comes to calculating the ERP (Effective Annual Rate) of an investment, it is important to understand the formula behind it. The ERP Calculator Formula takes into account various factors such as the nominal interest rate, frequency of compounding, and the number of compounding periods. By using this formula, investors can determine the true annual rate of return on their investment, taking into consideration the effects of compounding.

The first component of the ERP Calculator Formula is the nominal interest rate. This is the rate that is stated by the financial institution or lender, and is typically the rate that is advertised to potential investors. However, the nominal interest rate does not take into account the effects of compounding, which is why the ERP Calculator Formula is necessary to calculate the true annual rate of return.

Next, the frequency of compounding plays a crucial role in the ERP Calculator Formula. This refers to how often the interest is calculated and added to the principal amount. The more frequently interest is compounded, the higher the effective annual rate will be. For example, if interest is compounded quarterly, the effective annual rate will be higher than if it is compounded annually.

In addition to the nominal interest rate and frequency of compounding, the number of compounding periods is also a key factor in the ERP Calculator Formula. This refers to the total number of times that interest is compounded over the course of a year. The more compounding periods there are, the higher the effective annual rate will be. This means that investors should pay attention to not only the nominal interest rate, but also how frequently interest is compounded and the total number of compounding periods.

By using the ERP Calculator Formula, investors can gain a better understanding of the true annual rate of return on their investment. This formula takes into consideration all of the factors that impact the effective annual rate, allowing investors to make informed decisions about their investments. Whether you are looking to calculate the ERP for a savings account, certificate of deposit, or any other type of investment, understanding the ERP Calculator Formula is essential.

Calculating ERP with Excel

Calculating ERP with Excel is a simple and efficient way to determine the effective rent for a lease agreement. This formula takes into account all costs associated with leasing a property, including base rent, operating expenses, and other additional fees. By using Excel, you can easily input the necessary information and calculate the ERP in a matter of minutes.

To calculate ERP with Excel, first, you need to gather specific information about your lease agreement. This includes the base rent amount, operating expenses, taxes, insurance, and any other costs related to the property. Once you have all the required data, you can start inputting this information into an Excel spreadsheet.

Start by creating a new Excel spreadsheet and labeling the columns with the appropriate categories such as Base Rent, Operating Expenses, Taxes, Insurance, and Total Rent. In the rows below each category, input the corresponding cost for each item. Once you have all the numbers inputted, you can start calculating the ERP.

To calculate the ERP, you will need to add up all the costs associated with the lease agreement. This includes the base rent, operating expenses, taxes, insurance, and any other additional fees. Once you have the total sum of all costs, you can divide this amount by the total square footage of the property to get the ERP per square foot.

For example, if the total sum of all costs is $100,000 and the total square footage of the property is 10,000 square feet, the ERP per square foot would be $10. This means that for every square foot of space leased, the tenant would effectively be paying $10.

Using Excel to calculate ERP makes it easy to input and manipulate data for lease agreements. You can easily update the spreadsheet with any changes to the lease terms or costs, and the formula will automatically recalculate the ERP for you. This makes it a convenient tool for landlords, tenants, and real estate professionals to analyze lease agreements and determine the true cost of leasing a property.

Factors Affecting ERP Calculation

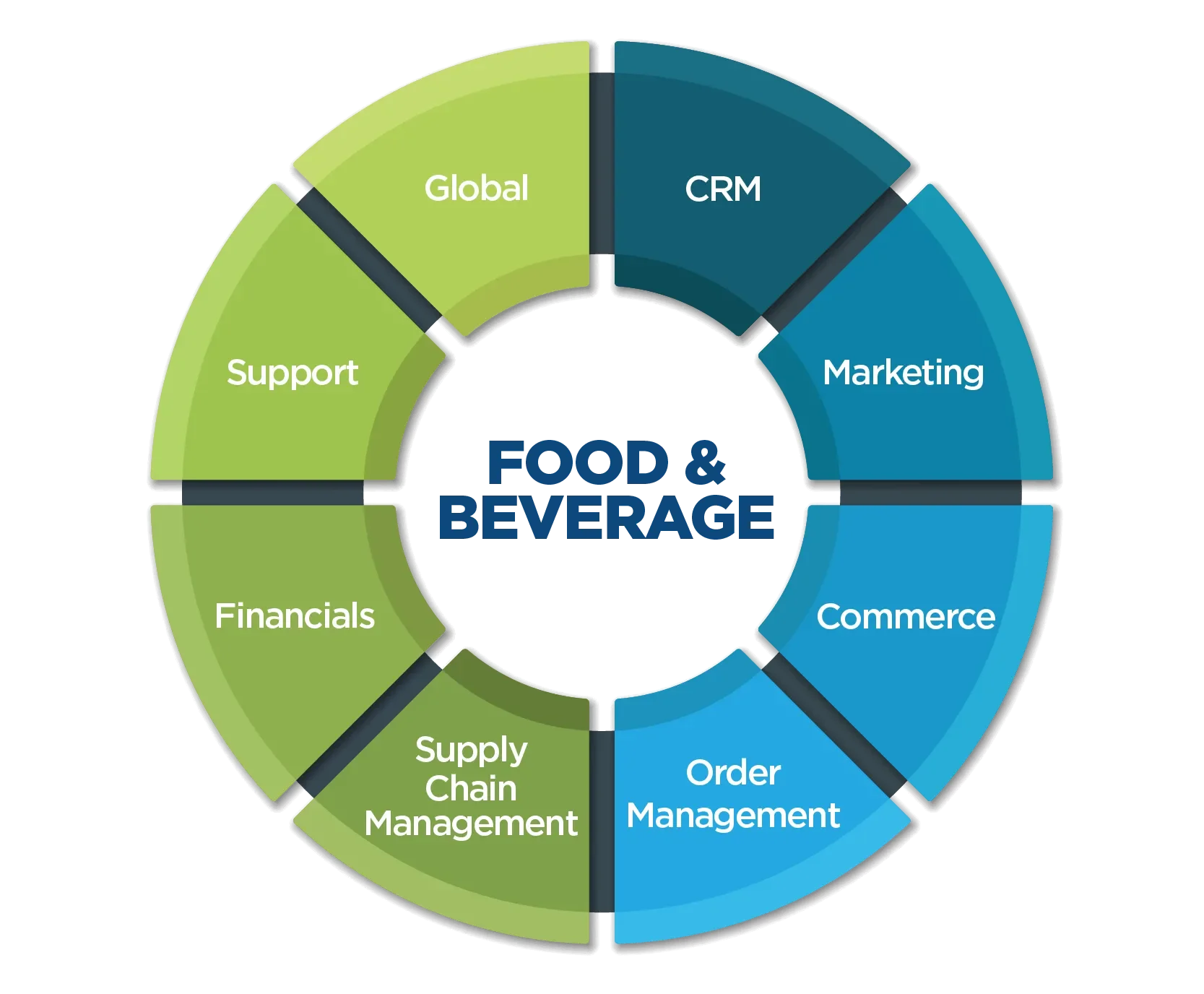

When it comes to calculating an ERP (Enterprise Resource Planning) system for a business, there are several factors that can influence the final figure. These factors can vary depending on the industry, size of the organization, and specific needs of the business. Here are some key factors that can affect ERP calculation:

1. Industry: Different industries have different requirements when it comes to ERP systems. For example, a manufacturing company may require more complex modules such as supply chain management and production planning, while a service-based company may only need modules for project management and customer relationship management. The complexity of the industry and the specific needs of the business will impact the ERP calculation.

2. Size of the organization: The size of the organization, in terms of number of employees, departments, and locations, will also affect the ERP calculation. Larger organizations with more users and modules will typically have higher ERP costs due to the increased complexity and scale of the implementation. Smaller organizations may be able to use a simpler and less expensive ERP system.

3. Customization and integration: One of the biggest factors that can impact ERP calculation is the level of customization and integration required for the system. Customizing the ERP system to fit the specific needs of the business, such as adding new modules or integrating with existing software, can significantly increase the cost of the implementation. Integration with other systems, such as accounting software or CRM tools, can also add to the overall cost of the ERP system.

When considering customization and integration, it’s important to weigh the benefits of having a tailored system against the additional costs. While a customized ERP system may provide better functionality and efficiency for the business, it can also require more time and resources to implement. Understanding the specific customization and integration needs of the business is essential in accurately calculating the ERP cost.

In conclusion, factors such as industry, size of the organization, and customization and integration requirements all play a role in determining the final cost of an ERP system. By carefully analyzing these factors and working with an experienced ERP provider, businesses can ensure that they are getting a system that meets their needs and fits within their budget.

Tips for Using ERP Calculator Efficiently

Using an ERP calculator efficiently can greatly benefit your business by helping you accurately calculate costs and make informed decisions. Here are some tips to help you get the most out of your ERP calculator:

1. Understand the Formula: Before using the ERP calculator, take some time to understand the formula it uses to calculate costs. This will help you input the correct data and interpret the results accurately. The formula may vary depending on the specific features of the ERP calculator you are using, so make sure to familiarize yourself with it.

2. Input Accurate Data: One of the most important aspects of using an ERP calculator is inputting accurate data. Make sure to gather all the necessary information before using the calculator, such as production costs, material costs, labor costs, and overhead expenses. Inputting incorrect or incomplete data can result in inaccurate calculations and decisions.

3. Regularly Update Information: It’s essential to regularly update the information in your ERP calculator to ensure that your calculations remain accurate. As costs and other variables change over time, updating the data will help you make more informed decisions and keep track of any fluctuations in expenses.

4. Utilize Historical Data: One effective way to use an ERP calculator efficiently is to make use of historical data. By analyzing past costs and performance, you can identify trends, patterns, and areas for improvement. Historical data can help you make more accurate predictions and set realistic goals for your business.

For example, by inputting sales data from previous years into the ERP calculator, you can forecast future sales and adjust your production and inventory levels accordingly. Similarly, analyzing past expenses can help you identify cost-saving opportunities and optimize your budgeting strategies.

By utilizing historical data in your ERP calculator, you can gain valuable insights into your business operations and make data-driven decisions that will ultimately improve your bottom line.

5. Customize Reports: Many ERP calculators offer customizable reporting features that allow you to tailor the results to your specific needs. Take advantage of these features to generate reports that are relevant to your business goals and objectives. Customizing reports can help you track key performance indicators, monitor progress, and identify areas that require attention.

6. Seek Training and Support: If you’re new to using an ERP calculator or software, consider seeking training or support from the provider. Many ERP software vendors offer training programs, webinars, and customer support to help you navigate the system effectively. Taking advantage of these resources can help you maximize the benefits of the ERP calculator and improve your overall efficiency.

By following these tips, you can use an ERP calculator efficiently to streamline your business operations, make informed decisions, and achieve your financial goals. With accurate data, historical insights, and customizable reporting features, an ERP calculator can be a valuable tool for optimizing your business processes and driving growth.

Common Mistakes to Avoid in ERP Calculation

When it comes to ERP calculations, there are some common mistakes that companies make that can significantly impact the accuracy of their calculations. Avoiding these mistakes is crucial to ensuring that your ERP implementation goes smoothly and that you are able to reap the full benefits of the system. Here are five common mistakes to avoid in ERP calculation:

1. Not accounting for all costs: One of the biggest mistakes that companies make when calculating ERP costs is not accounting for all the expenses associated with the implementation. This includes not only the upfront costs of purchasing the software, but also the ongoing costs of training employees, maintaining the system, and upgrades. Failing to account for all of these expenses can lead to significant cost overruns and budgeting problems down the line.

2. Underestimating the time and resources required: Another common mistake is underestimating the amount of time and resources that will be required to implement an ERP system. ERP implementations are complex and time-consuming projects that require careful planning and coordination. Failing to allocate enough time and resources to the project can result in delays, cost overruns, and a system that does not meet the company’s needs.

3. Ignoring the needs of end users: One of the key factors in the success of an ERP implementation is user adoption. If end users do not buy into the system or find it difficult to use, the implementation is likely to fail. One common mistake that companies make is not involving end users in the implementation process or failing to consider their needs and preferences. It is important to engage end users early on in the process, involve them in decision-making, and provide training and support to ensure that they are able to effectively use the system.

4. Overlooking the importance of data quality: Data is the lifeblood of an ERP system, and ensuring the accuracy and reliability of data is crucial to the success of the implementation. One common mistake that companies make is overlooking the importance of data quality and failing to properly clean and prepare their data before migrating it to the new system. Poor data quality can lead to errors, inconsistencies, and inefficiencies in the system, so it is important to invest the time and resources upfront to ensure that your data is clean and accurate.

5. Failing to conduct a comprehensive risk assessment: Finally, one of the most common mistakes that companies make in ERP calculations is failing to conduct a comprehensive risk assessment. ERP implementations are complex projects that involve a high degree of risk, including the risk of project delays, cost overruns, and system failures. Failing to identify and mitigate these risks can have serious consequences for the success of the implementation. It is important to conduct a thorough risk assessment before embarking on an ERP project, identify potential risks, and develop strategies to mitigate them.

Originally posted 2024-01-06 08:08:02.